Hard Disk Prices to Remain High Through 2014

While hard drive (Hard disk drive) supplies are beginning to resurge, inventories won’t be back to normal before the third quarter of the year and costs will stay abnormally high through 2014, according to researching the market firms IHS iSuppli and Coughlin Affiliates.

Consequently of flooding in Thailand this past year, Hard disk drive prices will probably increase 20% to 30% over their average pre-ton prices and turn into there through the majority of 2012, Coughlin Affiliates stated in the report today (download PDF).

Furthermore, the hard disk manufacturing industry may have to spend about $1 billion to replace and repair manufacturing plants broken through the monsoonal flooding.

Hard disk drive supplies within the 4th quarter of 2011 fell by 26% in comparison to exactly the same period this year, according to IHS iSuppli. Deliveries are positioned to decline by another 13% within the first quarter of 2012 by 5% within the second quarter with an annual basis.

The typical global value for HDDs jumped by 28% within the 4th quarter of 2011, according to IHS iSuppli. While prices will decline by 3% within the first quarter by 9% within the second quarter, they’ll remain inflated for the entire year.

“Prices will stay high for several reasons, such as the greater costs connected using the moving of production, in addition to greater component costs due to flooding impacts among component makers,” stated Fang Zhang, a storage analyst for IHS iSuppli.

PC prices may also be affected because system makers have signed annual contacts with Hard disk drive makers which have locked them into elevated prices deals for that relaxation of the season, Zhang noted.

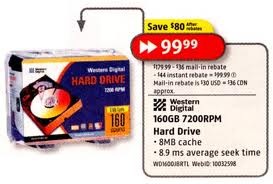

Furthermore, industry Hard disk drive consolidation could hold prices greater than pre-ton levels for any couple of more quarters because you will find less rivals on the market, IHS iSuppli stated. It had been mentioning to mergers between Seagate and Samsung and between Western Digital and Hitachi GST.

Inside a report launched Friday, iSuppli predicted the Thailand flooding continues to have an affect on inventory and costs until deliveries rise first by 2% within the third quarter, then a 42% surge within the 4th quarter of 2012.

“The recovery of worldwide Hard disk drive manufacturing has started and can continue throughout each quarter of 2012, hard disk drive prices will stay inflated and inventories continues to be depleted, showing that demand is exceeding supply. Demand and supply should return to balance through the finish from the third quarter.” Zhang stated.

Coughlin Affiliates stated the mixture of industry consolidation and Thailand-related shortages, can lead to greater Hard disk drive prices a minimum of until 2014. The greater prices, however, can help fund costly new technology transitions by 2015 or 2016 and increase areal density growth rates by 40%.

The annual rate where hard drive areal densities increase has slowed down recently, Coughlin Affiliates stated.

However, drive capabilities continue to grow due to technology developments for example Warmth-Aided Magnetic Recording (HAMR). While hard disk areal density growth has slowed down, storage capabilities continue to rise: 3.5-in. HDDs with storage capabilities of 12TB and a pair of.5-in. HDDs with 6 B are required by 2016.

Due to reduced areal density growth, user companies may have to save money per gigabyte of drive capacity within the next 2 yrs. The typical hard disk capital equipment investing each year between 2008 and 2016 is believed at about 7.2% of hard disk industry revenue.